Last week, from Oct. 29 to 30, the government economic team went to London for a series of investment roadshows and meetings, then another Philippine Economic Briefing (PEB) on Oct. 31. This was after they had been in Washington DC for a series of meetings with the multilaterals, credit agencies, and some big commercial banks there.

From the photos and press releases, the economic team members who were in London were Department of Finance (DoF) Secretary Ralph G. Recto, Office of the Special Assistant to the President for Investment and Economic Affairs (OSAPIEA) Secretary Frederick Go, National Economic and Development Authority (NEDA) Secretary Arsenio Balisacan, Department of Energy (DoE) Secretary Raphael P.M. Lotilla, and Bangko Sentral ng Pilipinas (BSP) Deputy Governor Francisco Dakila, Jr.

Department of Budget and Management (DBM) Secretary Amenah F. Pangandaman, a member of the economic team was not with the group. I checked the DBM Facebook page — she had been at the Philippine International Convention Center where she a speaker at the International Conference on Women, Peace and Security (WPS) on the third and last day, Oct. 30.

The Philippines Open Government Partnership (PH-OGP), chaired by Ms. Pangandaman, convened many notable women leaders from the Philippines and abroad for a discussion on the theme, “Empowered Women, Lasting Peace: Advancing the Women, Peace, and Security Agenda Through Open Governance.”

Meanwhile, at the PEB, Mr. Recto highlighted that “British investors brought 585.74 million British pounds of investments to the Philippines as of the end of July…. 97 British companies currently operate in our economic zones…. The Philippines is booming and has all the makings of a tiger economy…. we are among the best performing economies in ASEAN, with GDP growth averaging 6.1% since President Ferdinand R. Marcos, Jr. took office.”

Going back to Europe, London in particular, is a good move by the economic team mainly because Europe is limping economically now, so many companies there are looking for other countries as good investment alternatives. Asia in general, and Philippines in particular, should be a good destination for them.

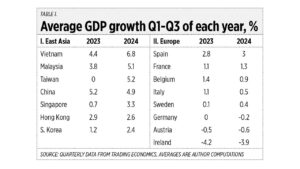

Consider the economic performance of several European and Asian economies over first to third quarter (Q1-Q3) this year compared to last year (see Table 1).

Also at the PEB, NEDA Secretary Balisacan discussed many big infrastructure projects under the Public-Private Partnership (PPP): 214 projects which are under implementation (15 are Infra Flagship Projects or IFPs) with total estimated project cost of P3.575 trillion. And 173 projects are in the pipeline (29 are IFPs) with a total estimated project cost of P3.174 trillion. So, a total of P6.749 trillion — that is huge.

Aside from the PPPs, there are also many foreign assisted projects (FAP), or foreign aid from the multilaterals and bilateral organizations, for infrastructure. Local counterpart funding is needed for these FAPs to be disbursed.

ON PHILHEALTH AGAINWe need more money for these FAP counterpart funds and for other social service spending in the unappropriated expenditures. The Philippine Health Insurance Corp. (PhilHealth) has the money from excess remittances by the National Government (NG) to PhilHealth to subsidize millions of non-contributing indigents, senior citizens, other government-sponsored individuals and households.

I looked through some PhilHealth finance reports where I saw that the P89.9 billion in excess funds came from three years of accumulated remittances by the NG (see Table 2).

That item “NG premium for indirect contributors” would be better called “NG collections from gamblers and bettors, drinkers, smokers and vapers.” That money comes from remittances by the Philippine Amusement and Gaming Corp. (better known as PAGCOR), the Philippine Charity Sweepstakes Office or PCSO, and excise taxes on alcohol and tobacco products. That money does not come from those employed in the formal sector, nor from indigents, not from senior citizens (who are non-contributing), and not from other sponsored individuals.

There are fears that PhilHealth’s equity is turning negative. This is because of the P1 trillion+ provision for Insurance Contract Liabilities (ICLs). ICL is Present Value of Future Outflows (benefit payments plus administrative expenses) minus Present Value of Future Inflows (Premium collections plus interest earnings).

So ICLs are just estimates, not backed up by actual claims or contracts with hospitals and health professionals. It should not be considered as a big parameter or factor in the reallocation of excess funds for current actual needs.

The government, through the DoF, has the legal right, has the moral ascendancy, to take back those excess funds to fund additional big infrastructure and additional social services that will create more jobs and reduce the number of jobless, and reduce the number of indigents.

Healthcare is first and foremost a personal and parental responsibility, secondarily a government responsibility. People should pay for their own healthcare, even at a minimal amount, and not everything should depend on the government.

THE US ELECTIONSMeanwhile, the US Presidential and Congressional elections are being held tomorrow (Nov. 5 in the US, which is Nov. 6 in the Philippines). The US economy, the millions of new illegal immigrants, the ongoing US military involvement in many wars abroad (Ukraine, Israel, Syria, etc.) are among the key issues for the voters.

I checked the US’ total outstanding public debt and it is huge: As of Oct. 31, 2024, it comes up to $35.952 trillion. In comparison, on Oct. 31, 2023, it was $33.700 trillion; Oct. 31, 2022, $31.238 trillion; Oct. 29, 2021, $28.909 trillion; and Oct. 30, 2020, $27.135 trillion.

On Sept. 30 this year, it was $35.465 trillion; on Aug. 30, it was $35.256 trillion; and on July 31, $35.105 trillion. So, from October 2023 to October 2024, there was an increase in US public debt of $2.252 trillion or $6.17 billion/day. From September to October this year, there was an increase of $487 billion or $15.71 billion/day. From August to September, $209 billion or $6.97 billion/day. And from July to August, $151 billion or $5.03 billion/day.

So, last month, the last month before the US elections, the Biden-Harris administration was over-borrowing by $15.7 billion per day. Horrible fiscal irresponsibility.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.