(Part 1)

The well-publicized and livestreamed hearings in the Philippine Supreme Court about the constitutionality or legality of the Department of Finance (DoF) taking out P89 billion from the funds of PhilHealth (Philippine Health Insurance Corp.) put a spotlight on the special provision in the General Appropriations Act (GAA) of 2024 and the corresponding DoF Circular 003-2024. It was this “rider” in the GAA that Finance Secretary Ralph Recto invoked in saying that the DoF was just “following the law,” in contravention of explicit provisions of the Universal Health Care Act (R.A. 11223), especially Section 11, and the sin tax laws (R.A. 10351 and R.A. 11346).

This article discusses how a similar DoF action in taking out “excess funds” from GOCCs — in this case a much bigger amount, P107 billion, from the Deposit Insurance Fund (DIF) of the PDIC (Philippine Deposit Insurance Corp.) — has a striking parallel to the PhilHealth case, and in my view followed a logic that appears to be just as indefensible.

PDIC charter RA 10846 mandates it to provide deposit insurance and ensure the stability and safety of the banking system.

The PDIC issue boils down to several key questions:

1. What level of deposit insurance fund is considered adequate and prudent? Part 1 of this article covers this question.

2. If the DIF is deemed more than adequate, does the National Government have a basis to take money from the DIF, over and above the dividends? Part 2 covers this question and the next question.

3. What is the money from the “excess funds” to be used for?

To answer the first question, a good framework is the research paper made by the International Association of Deposit Insurers (IADI) “Deposit Insurance Fund Target Ratio” published in July 2018.

The paper showed a survey of various jurisdictions, how they differ in their approaches to targeting an appropriate ratio of DIF to insurable deposits considering factors such as financial system structure and characteristics, the prudential regulation regime, legal framework, macroeconomic conditions, and availability of emergency funding and the state of accounting and disclosures. Table 1 shows the wide range of deposit insurance ratios (whether set by law or by the deposit insurance agency):

The Philippine ratio of insurance fund to insurable deposits of 5.5% to 8% is somewhere in between the highs of 10% for Montenegro, 8-10% for Jamaica and 8-9% for Kosovo to as low as 0.25% for Hong Kong, and 0.3% for Singapore which are both developed city jurisdictions.

The rest of our Asian neighbors appear to be on the low side with 0.5% for Brunei, 2% for Chinese-Taipei, 2.5% for Indonesia, a range of 0.6% to 0.9% for Malaysia, and 4% for Mongolia.

Is the Philippines banking system “overinsured”? At first glance, it is tempting to conclude from Table 1 that the Philippine deposit system has “overprovided” and therefore there is an excess. While the cross-country comparisons are informative, each DIA considered their respective macroeconomic conditions, financial system structures, and other relevant factors.

The bottom-line is that in the course of performing its mandate, PDIC clearly:

1. Adopted a deposit insurance ratio target which it considered appropriate.

2. Adopted a range target instead of a single point target.

As of year-end 2023 (PDIC 2023 annual report page 66), PDIC continued to adopt a fund target ratio of 5.5% to 8% as a measure of the capital adequacy of the DIF in relation to the estimated insured deposits in the banking system. The Deposit Insurance Target Ratio framework was drawn up by an expert engaged through the World Bank (source: PDIC annual report).

The ratio represents PDIC’s ability to cover risk and promptly respond to insurance calls to maintain depositor confidence. The lower limit of 5.5% covers the PDIC’s anticipated risks and unanticipated risks under normal circumstances. On the other hand, the upper limit of 8% covers the anticipated and unanticipated risks with consideration for any possible repercussion of contagion (systemic risks) in the banking system.

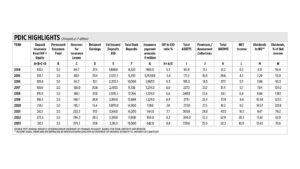

Key Point: From 2014 to 2023, the amount of insurance payments by PDIC has declined substantially from between P1 billion and P2 billion, to well below P1 billion from 2020 to 2023. The figures in Column G of Table 2 were provided by PDIC management, filling in the data gaps from annual reports. These numbers seem to suggest that the Reserve for Insurance Fund was more than adequate. It would be interesting to see if the PDIC has a board resolution that officially made that determination.

As Table 2 shows (using data from 2014 to 2023 annual reports), the PDIC committed to build up the ratio of Deposit Insurance Fund to Estimated Insurable Deposits (DIF/EID) from 5.3% in 2014 to 8.8% in 2023. The DIF has three components: a permanent insurance fund (constant amount of P3 million), reserves for insurance losses which constitute the bulk of the DIF, and retained earnings of PDIC. In sum, the DIF is also the total equity of PDIC.

The DIF/EID ratio of 5.5% to 8% is subject to periodic review after three years. A logical process would have started with such a review, which would have determined whether changing the target ratio is in order. There was no indication in the PDIC annual reports that such a review has taken place.

The transfer of P107 billion from PDIC represents a reduction in the DIF/EID ratio from 8.8% to the 5.5% ratio or where it was 10 years ago. This means three things:

1. There was a sudden realization (epiphany?) at the PDIC board (for a long time headed by the Secretary of Finance, but starting 2022 chaired by the Bangko Sentral ng Pilipinas Governor) that the extra buffer to cover for systemic or contagion risks — which was painstakingly built up over 10 years — is no longer needed. This seems counterintuitive to the perception that the global environment is becoming more complex and characterized by VUCA (volatility, uncertainty, complexity, and ambiguity). This reasoning also sounds very much like a post hoc rationalization of a fait accompli that the National Government/DoF simply needs the money.

2. The National Government took out much more than the usual dividends it previously received from PDIC. Prior to this large-scale transfer of P107 billion, the National Government simply received dividends from PDIC (Column M, Table 2) which actually exceeded 100% of net income during the Duterte years (Column N). To be fair, the dividend to net income ratio was below 100% during the Marcos Jr. years 2022 and 2023.

3. It cut down PDIC equity by one-third, from P310 billion to P203 billion. This is similar to the reduction in capital of Land Bank and Development Bank of the Philippines as a result of their equity contributions to Maharlika Fund.

(To be continued.)

Alexander C. Escucha is the president of the Institute for Development and Econometric Analysis, Inc., and chairman of the UP Visayas Foundation, Inc. He is a fellow of the Foundation for Economic Freedom and a past president of the Philippine Economic Society. He is an international resource director of The Asian Banker (Singapore).