The other week, on Aug. 14, I attended the AmCham 8th Energy Forum held at Marriott Hotel Manila and energy transition dominated the discussion. Last week, on Aug. 21, I was one of session speakers in the Philippine Chamber of Commerce and Industry-Indonesian Chamber of Commerce and Industry (PCCI-KADIN) Business Forum, held at the PCCI HQ in Taguig City, I and my co-speaker, Iman Arif, talked about the beauty of coal energy.

These terms — energy transition (from fossil fuels to intermittent renewables), net zero, and decarbonization — are for me economically irrational. The real energy transition we should work for is from unstable, blackout-friendly, and expensive energy to abundant, stable, cheap energy in order to achieve lower inflation and higher growth. Below are the numbers.

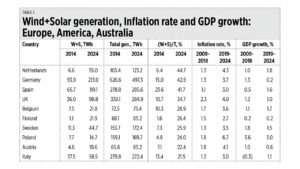

First, I added the total generation of wind plus solar (W+S) in 2014 and 2024, then computed the share of W+S over total generation, the (W+S)/T ratio. Then I got the average inflation rate and average GDP growth that touched those periods, 2009-2018 and 2019-2024.

The results are clear: countries with a (W+S)/T ratio of 20% and up have all seen rising inflation over those two periods, especially the Netherlands, Germany, the United Kingdom, Belgium, Poland, Sweden, Austria, Australia, and Chile. Even countries with medium (W+S)/T ratio of 9-16% also experienced rising inflation, like Canada and the USA.

Many of these countries also experienced low or declining GDP growth, especially Germany, the UK, Austria, Argentina, and Mexico. And two countries have had an ugly trend of declining total power generation as they add more W+S in their grid — Germany and the UK (see Table 1).

In contrast, in many Asian nations that have low (W+S)/T ratios of between 0.4% to 18%, their inflation rate is declining, especially China, India, Vietnam, Malaysia, and Indonesia. And their average GDP growth is high, 3% and above, except Japan and Thailand.

Even Russia, with its continuing war in Ukraine, has experienced declining inflation and rising growth (see Table 2).

The Philippines is lucky to have a (W+S)/T ratio of only 3.9% and we should not aspire to raise it to 5% or higher. Rather, we should aspire to expand our total power generation. We generated only 130 terawatt-hours (TWh) in 2024, less than Malaysia and Thailand, less than half of Vietnam and Indonesia. Many big manufacturing companies will be scared to come and invest here because of the perennial yellow-red alerts and insufficient power supply.

Our electricity prices are higher than those of many of our ASEAN neighbors because they subsidize their energy while the Philippines taxes energy; and their power supply per capita is higher than ours, especially Malaysia, Singapore, Thailand, and Vietnam.

Currently, on-grid customers subsidize the customers in off-grid islands and provinces via a universal charge for missionary electrification (UC-ME) of P0.195 per kilowatt-hour (kWh). Then, all consumers subsidize intermittent renewables like W+S via the Feed-in Tariff Allowance (FIT-All) at P0.119/kWh.

At the AmCham energy forum, many speakers from the energy players talked about energy transition, net zero, and Green Energy Auction (GEA). As shown in the tables above, the actual and non-hypothetical numbers show that inflation rises as more renewables are added. It seems that some private energy players are praying for expensive electricity and higher inflation, so long as their businesses have assured high profits.

This will come in the form of a future GEA Allowance (GEA-All) tacked onto our monthly electricity bill, on top of FIT-All and UC-ME. This future GEA-All will be large — twice or four times the FIT-All — because of the huge solar and wind capacities that have been granted or will soon be granted with assured high prices.

The economic team, concerned with high inflation and its dampening effect on consumer spending and overall GDP growth, should warn the energy sector of the future economic sabotage of these ongoing moves.

We should have an agnostic energy policy that focuses on developing an abundant energy supply. I applaud the three energy players which have a large number of thermal plants that balance their renewables portfolio — Aboitiz Power, Meralco Power Gen (MGEN), and San Miguel Global Power. As MGEN President and CEO Manny Rubio often argued in various energy fora that I attended: “Energy Transition means people should benefit from the energy shift, reliability must remain the foundation — power has to be consistent and affordable.”

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.